Accenture's recent survey discloses that a mere 22% of CFOs at large corporations are adequately prepared for upcoming climate-related reporting and assurance demands. Adding other ESG reporting mandates, such as resource use and circularity, the percentage drops to only 10%, the survey found. This is despite the widespread expectation that sustainability reporting obligations will intensify in the coming years. Interestingly, those finance leaders who are well-prepared regard sustainability as a substantial opportunity for their firms.

Titled "From Compliance to Competitive Advantage," the survey engaged 730 CFOs and senior finance executives from companies with over $1 billion in revenue across 11 countries and 15 industries. Accenture also conducted comprehensive interviews with finance and sustainability leaders.

Key survey insights include:

Regulatory Pressure: Nearly 85% of respondents foresee an increase in mandatory sustainability disclosures in the next three years, with 90% agreeing that ESG issues will be a significant focus over the next five years.

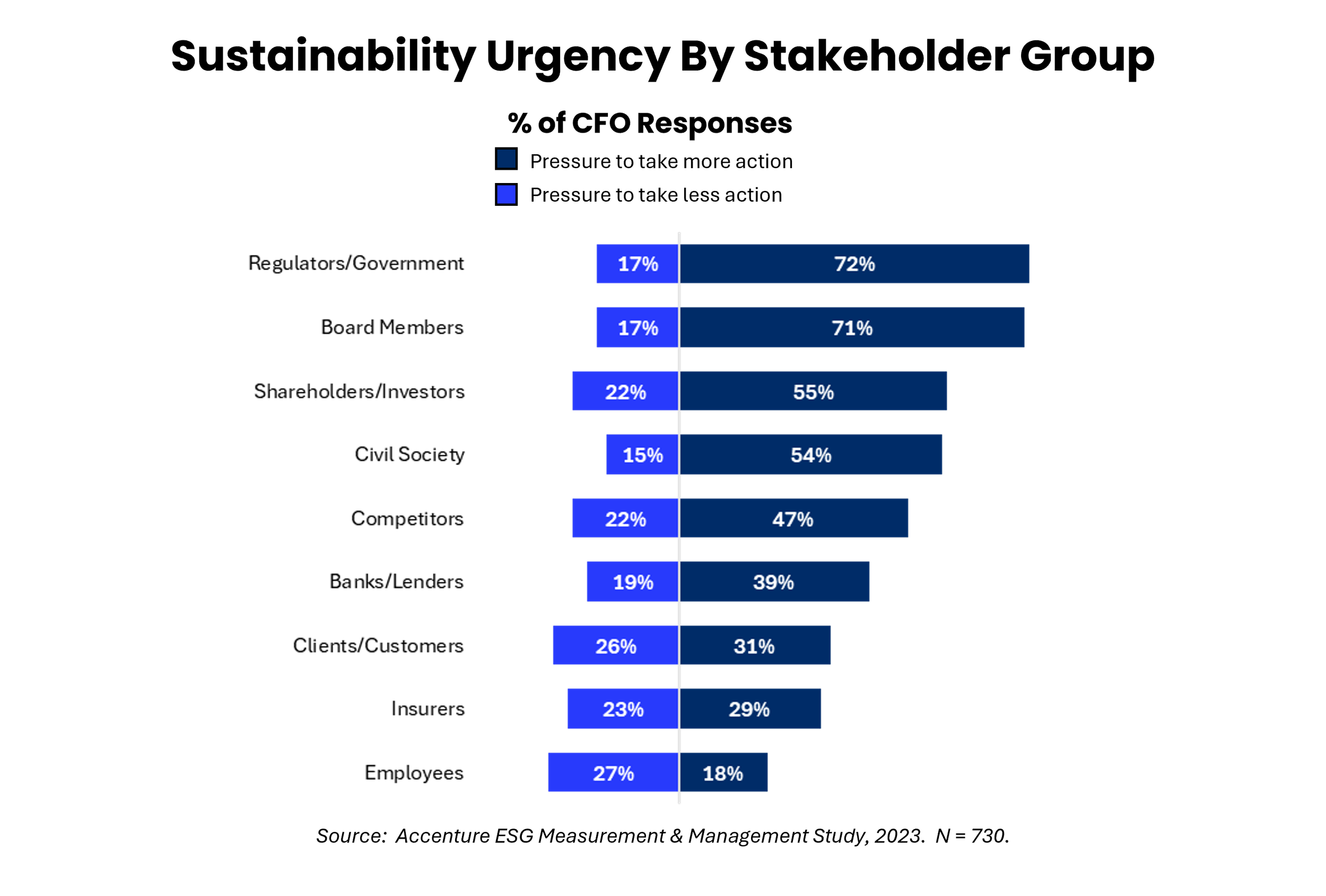

Stakeholder Pressure: Over 80% of finance executives feel pressure from at least three stakeholder groups—primarily regulators, board members, and shareholders—to address sustainability issues and take more action.

Readiness Gaps: Only 22% of CFOs feel well-prepared to disclose climate-related risks and opportunities and seek external assurance for these disclosures. Just 10% feel ready to meet broader sustainability reporting requirements, such as those related to resource use and circularity.

Accenture evaluated companies' readiness across nine key sustainability capabilities within ESG Measurement, ESG Management, and Talent categories. The report found 12% of companies to be weak, 73% moderately prepared, and 15% possessing strong capabilities.

The study underscores a strong link between robust ESG measurement and management capabilities and the perception of sustainability as a growth opportunity. For instance, 68% of companies in the "weak" category struggle to balance sustainability with profitable growth, compared to only 20% in the "strong" category. Additionally, companies with strong capabilities are twice as likely to see sustainability as a significant value driver.

Access the full survey here.

About Full Scope Insights

Full Scope Insights (FSI) is a boutique advisory and consulting firm that delivers leading edge services across Finance & Strategy, Sustainability, and Growth & Positioning. Our diverse client base includes progressive companies in the energy, technology, software, and manufacturing sectors, many of which are backed by top-tier private equity investors. For more information, please visit: www.fullscopeinsights.com.